Counterparty Credit Risk Screenings

Mitigate counterparty credit risk and make informed decisions with Sigma's comprehensive screening techniques and industry-leading, all-in-one platform

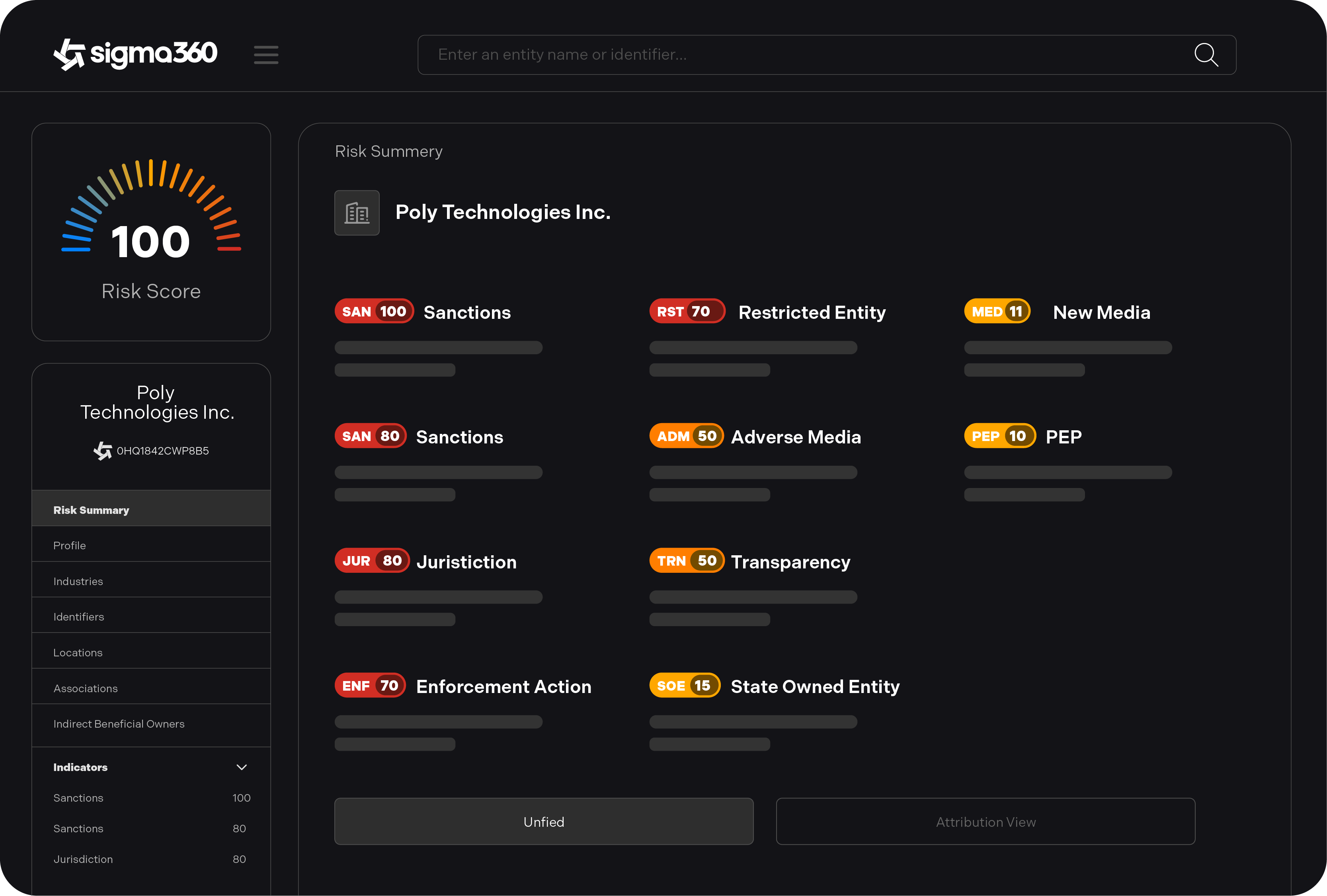

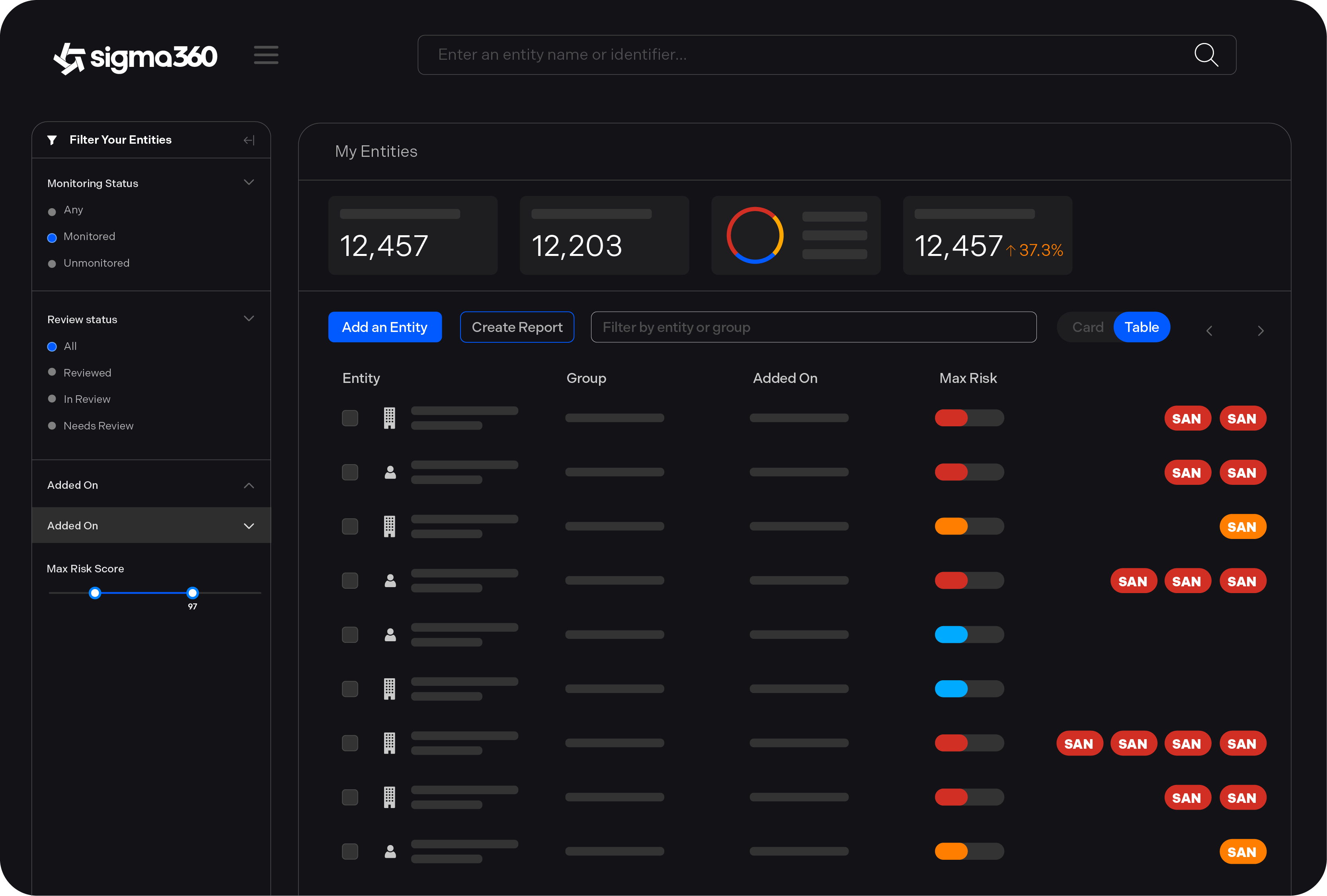

Customize, score, and strategically evaluate counterparty credit risk from a single platform

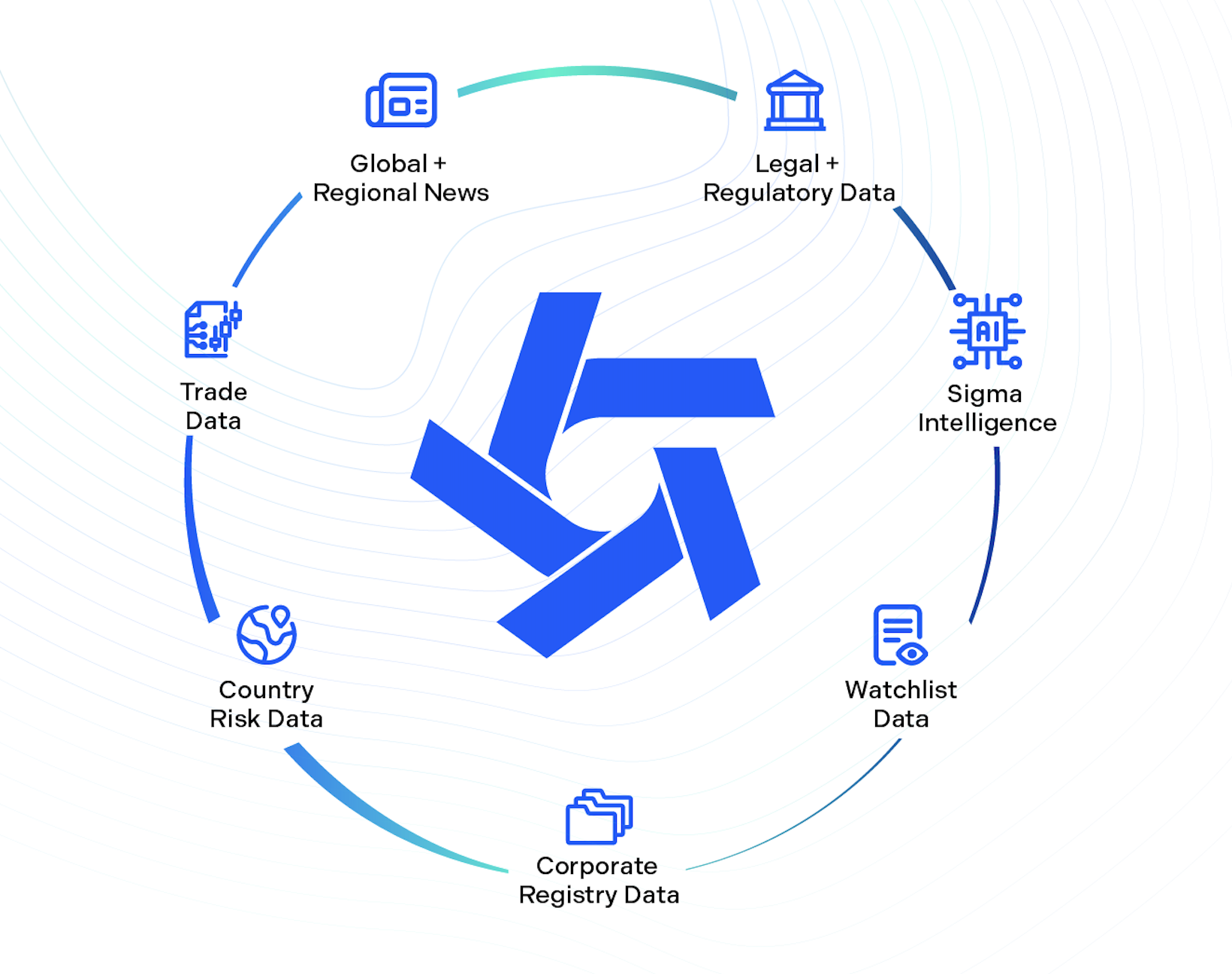

Sigma helps firms to evaluate and quantify risk for ongoing credit evaluation purposes by blending financial data, risk intelligence data, proprietary data, and applying a custom risk scoring framework. Our unique ability to create a complete picture of risk and also quantify it, helps firms detect, manage, and mitigate risks before larger issues emerge and make intelligent business decisions about their customers, their supply chain, or their customers’ customers.