Enhanced Due Diligence is a process that happens as part of Know Your Customer requirements and fits within the wider scope of Anti-Money Laundering (AML) policies. The goal of EDD is to detect financial crimes, money laundering and terrorist financing that could expose companies to financial or reputational damage. In addition to KYC and AML adherence, EDD is an essential component of customer onboarding, but it may also be triggered by periodic reviews or ongoing monitoring alerts.

EDD involves deeper investigations of high-risk customers, companies and transactions. Historically EDD investigations have been a reactive process, often requiring bulk reviews which may occur after the damage is done. Companies are now turning to preventive procedures for early detection through ongoing analysis of relevant risk categories.

When onboarding new clients, they undergo KYC and Customer Due Diligence (CDD) processes. Should a client be flagged under the high-risk category during KYC or CDD, based on parameters defined by an organization, they will then undergo more in-depth EDD workflows.

EDD requires:

As mentioned, EDD is needed for entities that fall under high-risk categorization.

For example, a high-risk customer may be identified as a Politically Exposed Person, or a high-risk business may be flagged for being cash-intensive. EDD would also be needed if an individual or business has suspicious activities that may raise financial crime risk concerns, including money laundering, corruption, other criminal activity, and adverse media.

Here are indicators that would trigger EDD:

The EDD process can include the following:

Other best practices include following the Financial Action Task Force (FATF) international standards. FATF recommends a Risk-Based Approach when there is a potential for your customers to have high-risk affiliations.

A Risk-Based Approach is a framework used to assess the level of risk to which a company or individual is exposed based on internal risk scoring methodology. Thresholds must be set high enough to avoid violating any international laws. Once high-risk customers are identified, AML measures commensurate with those risks are executed to mitigate the risk effectively.

There are many steps to support a Risk-Based Approach, including obtaining additional customer information, analyzing UBO source of funds, transaction monitoring, and adverse media checks.

According to the Financial Action Task Force (FATF) international standards, a Risk-Based Approach is recommended when your customers may have high-risk affiliations. A Risk-Based Approach framework assesses the level of risk a company or individual is exposed to, based on internal risk scoring methodology. Thresholds must be set high enough to avoid violating any international laws.

Once high-risk customers are identified, AML measures proportionate to those risks are executed to mitigate the risk effectively. There are many steps to support a Risk-Based Approach, including obtaining additional customer information, analyzing UBO source of funds, transaction monitoring and adverse media checks.

Enhanced due diligence goes beyond CDD, in that it requires obtaining extra documentation for identity verification using more than one external document, which can include:

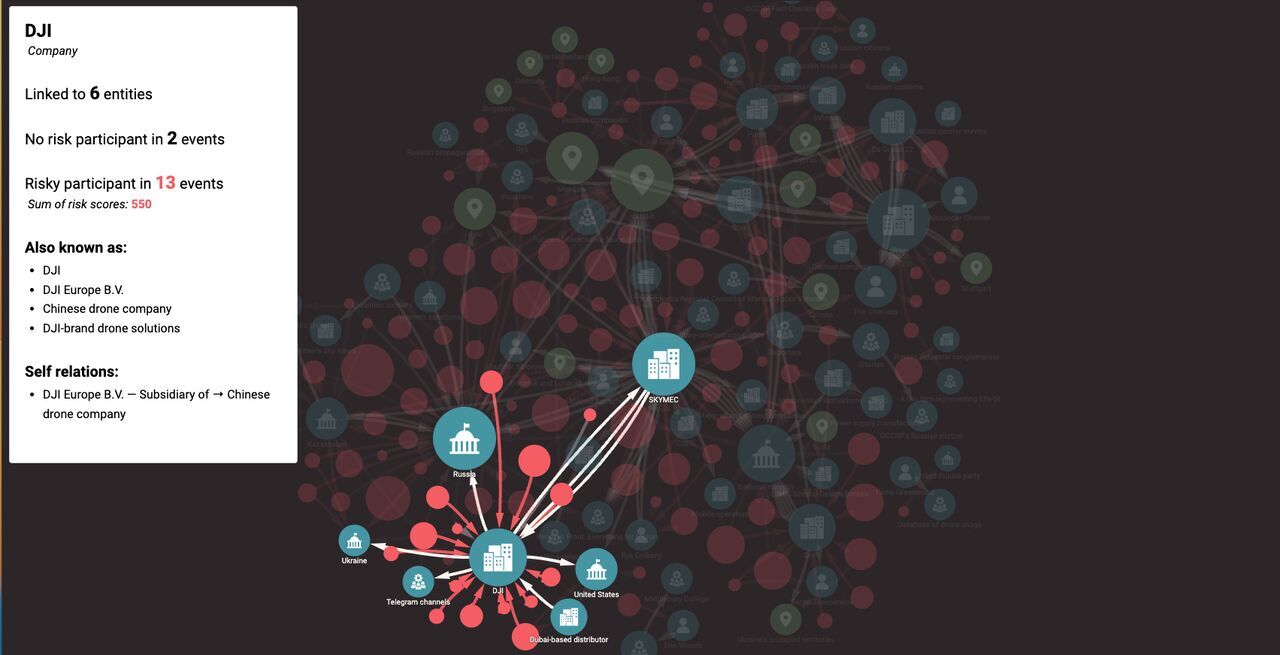

According to FATF, an Ultimate Beneficial Owner (UBO) “refers to the natural person(s) who ultimately owns or controls a customer and the natural person on whose behalf a transaction is being conducted. It also includes those persons who exercise ultimate effective control over a legal person or arrangement." To accurately perform Beneficial Ownership Validation, all layers of ownership must be thoroughly vetted and verified until all beneficial owners are accounted for, and the proper validating documentation is received.

Address the following:

If you want to learn more about identifying UBOs within your observed network, check out our blog on UBOs and their importance and identification processes for gathering more information.

Transaction history is a fundamental element of financial analysis. It includes transaction details, such as the background, purpose, nature, and duration of the transaction, as well as the parties involved. A financial institution should search for information related to the customer’s prior transactions, and present ones if available.

Effective EDD includes up-front assessment and ongoing transactions evaluation to determine any change in risk level. This means creating a framework that outlines regular assessment timelines and in-depth record-keeping.

Adverse media checks are critical to the success of any EDD process. To construct a successful EDD program, a company must clearly understand each customer’s reputation and whether or not they have been investigated for money laundering, terrorism financing, tax evasion, sanctions, or other unlawful activities.

A financial institution should perform adverse media checks on all high-risk customers as part of its EDD process. Ongoing monitoring is vital for a successful screening program. In addition to ensuring that customer-related data is regularly updated and remains accurate, monitoring helps organizations recognize patterns of potentially risky behavior and develop a more transparent, more accurate understanding of customers over time.

Without a physical address, or an address that does not correspond to official documents, a company may be at high risk of fraud. Conducting an on-site visit to the physical address is a requirement for all legal entities, including banks and companies. Documents that cannot be sourced digitally can be physically confirmed.

Risk-based monitoring is a strategy that allows businesses to monitor high-risk customers for illicit activity. It involves continuously monitoring their transactions and comparing them with the data and information they've already provided, and any suspicious activities that have been reported. Businesses can benefit from software that automates monitoring and alerts them of changes to their customers' profiles, like when a suspicious activity is tracked.

Enhanced Due Diligence is the further investigation needed for a customer who triggers alerts after CDD and KYC. While CDD involves capturing an initial customer risk profile through identification details provided by the customer, EDD is a more thorough 360° analysis of high-risk customers and their transactions.

EDD is different from CDD in that it pays special attention to:

To understand the entire picture of potential risks after a client is onboarded, indicators that point to PEP, money laundering, corruption, criminal activity and other adverse media can be useful during assessments. By gathering and consolidating all available data from disparate sources, organizations can have a solid understanding of relevant risk factors.

The three most helpful practices to follow include:

Tip 1: Consolidate risk for a complete picture of risk. There are many pieces of the puzzle when assessing risk, and each source of information can surface different risk factors. It’s important to bring disparate data together in order to adequately support findings in high-risk situations

Tip 2: Leverage real-time alerts for decision-making. Have an ongoing monitoring system for identified risk factors to keep you informed and up-to-date on the current situation

Tip 3: Create a strong culture of compliance within your organization. Companies must prioritize periodic staff training to review and update procedures for close examination of monitored entities. This form of training is crucial during staff onboarding

When dealing with high-risk entities, CDD does not provide enough descriptive information, presented in an efficient format, to indicate that financial fraud is happening. EDD can provide those insights. EDD involves analyzing various data sources to create a 360º analysis of risk. If the data sources are not unified and monitored consistently, it can be challenging to procure in-depth documentation.

Sigma Ratings provides a way to streamline the EDD process through a unified entity data management platform global risk intelligence and data monitoring management. If you're interested in learning more about how Sigma streamlines EDD, take a look and try a demo on how Sigma Ratings is your EED solution : https://www.sigmaratings.com/request-a-demo

Entity resolution is the process of stitching together multiple records relating to the same individual or business in order to get a more concise...

Fighting financial crime and enabling a more proactive risk management posture benefits from robust, always-on adverse media detection (also known as...

“Two heads are better than one”, as the old saying goes. However, in anti-money laundering and risk review, “four eyes are better than two” might be...