On pushing forward broader adoption

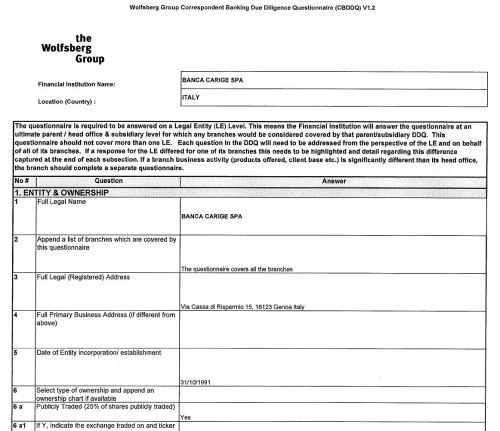

As we build deep, autonomous risk data linkages on financial institutions and corporates around the world, we are constantly tracking new trends (and their adoption). While our focus is on EMEIA and LATAM, it is interesting to note that it took looking at almost a thousand banks to find the first fully complete Wolfsberg Questionnaire.

Why is this important?

For one, none of them were in emerging or frontier markets.

No, the first example we found is for a mid-tier bank in Italy called Banca Carige. Specifically, Banca Carige’s report is the first found that has both: i) updated 2018 information; AND ii) a fully populated new Wolfsberg Report.

Nice job. However, before celebrating, please note that Banca Carige’s report is the exception and not the rule in Italy.

At Sigma Ratings, we supported the development of the new Wolfsberg format and have subsequently integrated it into our model. Wider scale adoption not only helps increase transparency, but it helps build deeper trust and understanding of risks and control environments at scale.

Last month, the announcement of Germany’s arrest of a businessman suspected of purchasing “sophisticated machinery” for Russian intelligence might...

Last week, the EU considered blacklisting the United Arab Emirates. The suggestion comes following a new data leak called ‘Dubai Uncovered,’ which...