In 2014 the Financial Stability Board (FSB) set up a standardized way to label and find the legal identity of any institution involved in financial transactions. Presumably, having this data in place helps people and businesses make smarter, less costly and more reliable decisions about who to do business with.

However, adoption is far from universal (there are leaders and there are laggards). This fact raises questions around broader transparency objectives in a time when it is more important than ever.

In the words of the Global Legal Entity Identifier Foundation (GLEIF):

The Legal Entity Identifier (LEI) enables clear and unique identification of legal entities engaging in financial transactions. Implementation of the LEI increases the ability of authorities in any jurisdiction to evaluate risk, conduct market surveillance and take corrective steps. Use of an LEI also generates tangible benefits for businesses including reduced counterparty risk and increased operational efficiencies.

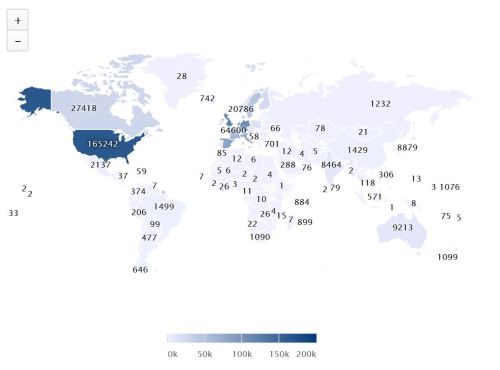

In digging into actual LEI coverage, we found an interesting correlation to other trends we are seeing at Sigma Ratings. Specifically, the data availability of information varies significantly across countries and regions. Moreover, even within highly regulated industries, like banking, we see inconsistent LEI availability.

For ease of reading, here are some of the highest number of LEIs in each region of the world (as well as global numbers for adoption comparison):

Global (by size of country & # of LEIs):

- Leaders: America (165,242), UK (126,676), Germany (108,278)

- Laggards: Russia (1,232), China (1,429),

Middle East:

- Leaders: United Arab Emirates (1589), Saudi Arabia (288)

- Laggards: Syria (1), Iraq (12)

Africa:

- Leaders: South Africa (1090), Nigeria (324)

- Laggards: Ethiopia (1), Niger (2), Chad (2), Guinea (2), Sierra Leone (2)

Latin America:

- Leaders: Brazil (1499), Chile (646), Argentina (477)

Last week, the International Journal of Finance and Economics published a study that appears to indicate that financial crime enforcement actions...

On pushing forward broader adoption

This week, the WSJ reported that trade sanctions were placed on dozens of Chinese firms in the last week. While the term ‘sanctioned’ might be...