Delivering ongoing monitoring to clients is a massive evolution of Sigma Ratings' platform, and our biggest launch to date. This release provides clients with proactive monitoring to manage potential and existing business relationships. In addition to a new KYC/KYB risk category, you can now continuously monitor for risk across all global datasets.

New KYC/KYB risk indicators are now accessible in all three Sigma solutions: Open Search, Monitoring, and Country Risk.

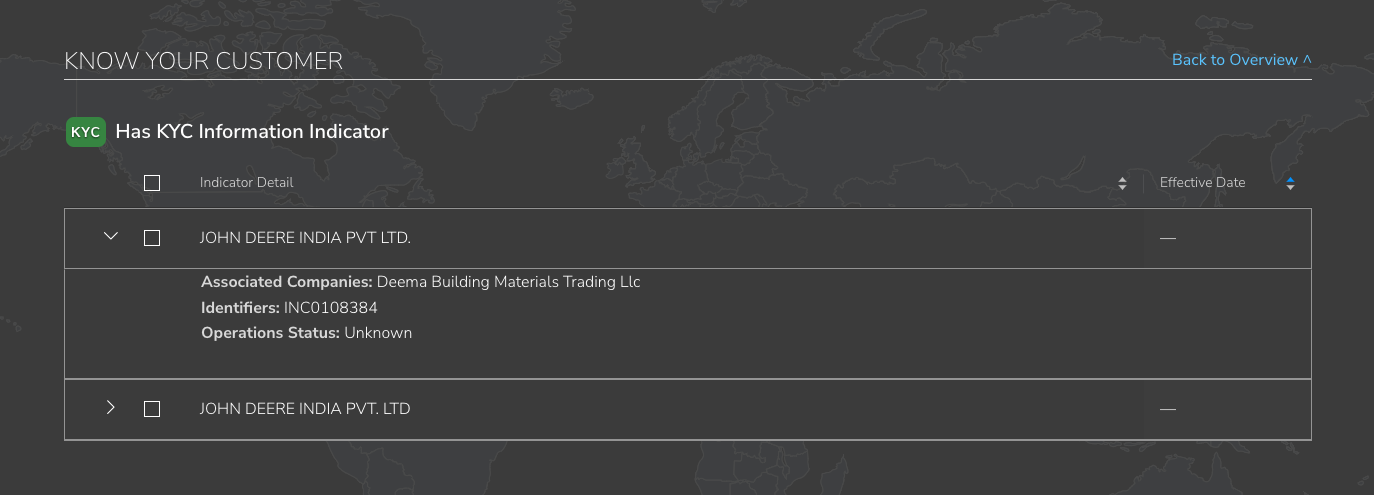

KYC risk indicators enable onboarding due diligence through key identification fields. Monitoring can be achieved by setting up alerts for changes in one or more of the following fields: IDs; Country; Associations; Regulated Status; Live/Dead Status; Industry code and description.

You can now set up proactive alerts across all our datasets. This means you receive a notification when there are changes to monitored fields. In addition to external datasets, you can also monitor Sigma’s Proprietary Intelligence data, which has expanded information for association risk, major leaks (think FinCEN files, Pandora Papers and others), high-risk activities, and Russia-focused data.

Through expert-trained AI and machine learning, easily derive actionable risk insights in our intuitive dashboard.

While expansive, Sigma data sources have been carefully curated by our global team of dedicated financial experts and analysts to ensure quality results.

We organize insights based on what matters to your business. Here is a complete list of risk categories Sigma Ratings offers to help you make sense of data:

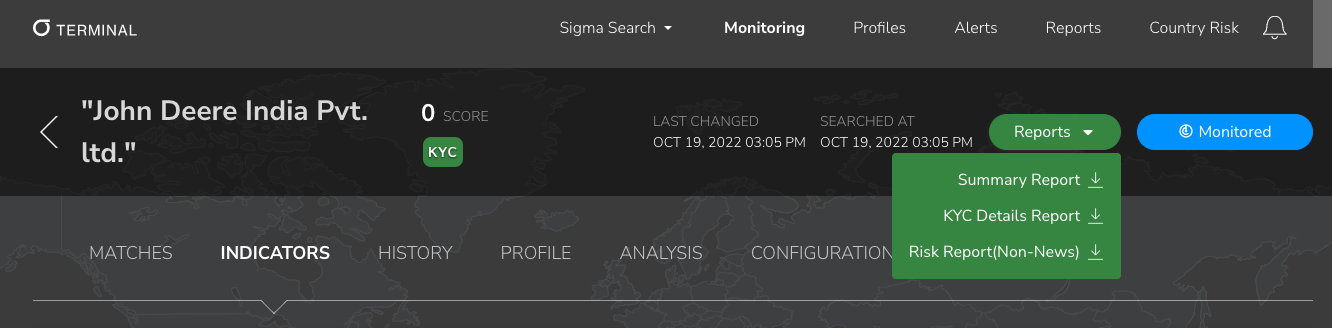

Having a clear and organized audit trail is essential to smooth compliance operations. Enhancements to Sigma Monitoring includes added user reports on monitored entities, including the following:

If you would like to understand how ongoing KYB & KYC monitoring can simplify your due diligence processes, please reach us at info@sigmaratings.com.

If you would like to understand how ongoing KYB & KYC monitoring can simplify your due diligence processes, please reach us at info@sigmaratings.com.

Last month, the Council on Foreign Relations reported that an arrest warrant issued by U.S. law enforcement for a prominent Nigerian policeman, for...

During a recent industry workshop, several leading institutions, including Goldman Sachs, HSBC and Citi, among others, indicated that they were in...