This week, the share price of Wirecard fell more than 60%, less than 2 years after its debut on the prestigious Dax index of the country’s 30 leading listed companies. Ironically, at the time, Wirecard had replaced Commerzbank, which is also battling its own scandal this week as a result of a £38m fine for money-laundering failings. For Wirecard, their debut saw its value skyrocket past Deutsche Bank and yet, this week, following allegations of cash balances totaling more than €1.9bn being “missing”, an amount that FT alleges amounts to “all the profits the group had declared since 2012,” it all came crumbling down.

So, what exactly went wrong at the company dubbed “Germany’s next great technological hope”? And were there any warning signs that appear to indicate what was to come?

We found some.

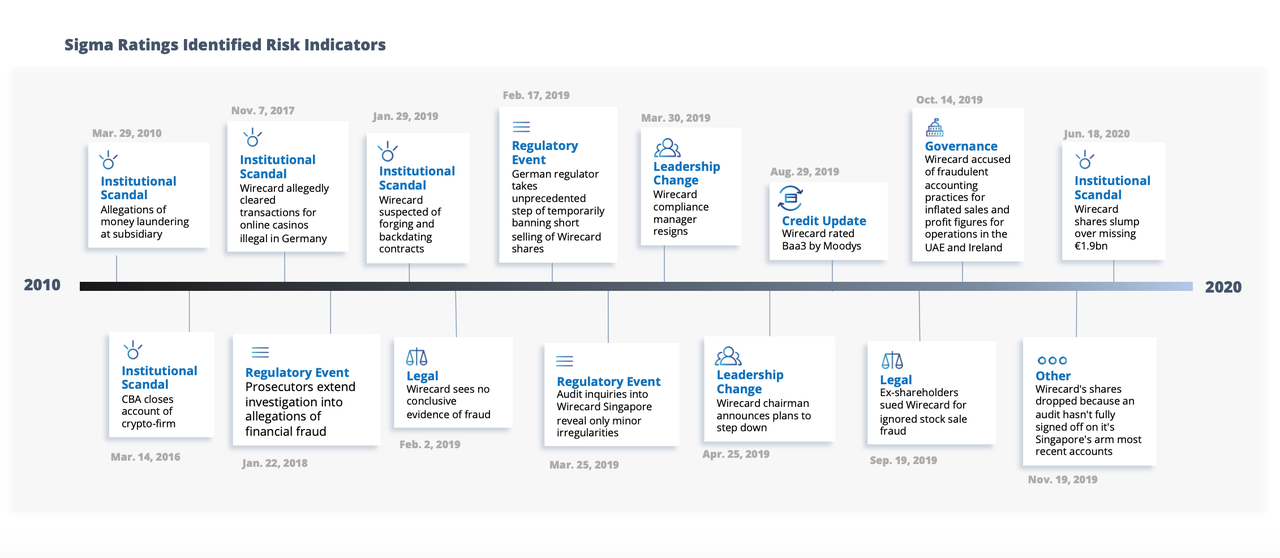

Sigma's event log detected over 100 key trigger events for Wirecard since 2010. Of this total, roughly a quarter were specific to Operational Changes, followed by Institutional Scandal (11.43%), Legal Issue (11.43%), Governance (8.57%), and changes in Leadership (7.62%).

Corporate governance is increasingly important and a critical point of discussion with companies we work with – both in terms of what they care about and want to monitor going forward. And it's understandable why. According to GMI Research, which conducted governance ratings on 3,800 global companies, those that improved their GMI rating by 3 points outperformed the S&P 500 index by 13.54%; thereby proving that the financial and non-financial factors affecting a firm aren't as mutually exclusive as previously thought.

The Association of Certified Anti-Money Laundering Specialists (ACAMS) released the ‘ACAMS Compliance Effectiveness and Risks Survey’ last month,...

This week, the United States agreed to remove Sudan from its terror blacklist on the condition that the country’s transitional government compensate...

Last week, the Basel Institute on Governance released its 2020 edition of the Basel AML Index. And what a surprise it was to discover that the...