This week, global firms find themselves in the crosshairs of increasing geopolitical tensions between the United States and China. The U.S.’ Hong Kong Autonomy Act, which was signed into law over the last week would “impose sanctions on Chinese officials cracking down on dissent in Hong Kong.” Notably, the legislation would allow for sanctions against financial institutions, including subsidiaries of U.S. banks, that deal with those officials, thereby restricting them from conducting U.S. dollar denominated transactions. Yet, according to the Brunswick Group, financial institutions in Hong Kong that comply with the legislation risk facing penalties for violations of China’s national security law imposed on Hong Kong as its “broad wording could allow for an interpretation that complying with U.S. sanctions constitutes collusion.”

Unsurprisingly, the commentary that followed remarked that HSBC and Standard Chartered, with their significant Hong Kong operations, “risk being caught up in the geopolitical struggle between the US and China.” Less than a week after Congress passed the legislation, HSBC and Standard Chartered saw their share price drop following reports that the U.S. was considering ways “to try and uncouple Hong Kong’s currency peg to the US dollar, possibly by making it harder for the city’s banks to buy [U.S. dollars].”

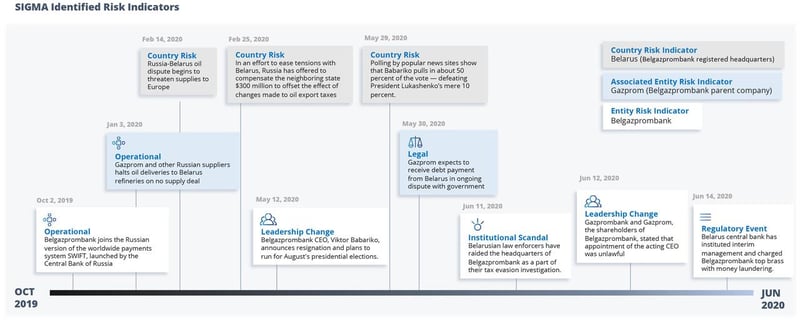

While only time will tell of the risks to the institutions with exposure to Hong Kong, we don’t have to look back far for a case of a financial institution caught up in a geopolitical struggle as evidenced by the case of Belgazprombank last month.

On June 11th, Belarusian security officials, citing a tax evasion investigation, raided Belgazprombank, a subsidiary of Gazprombank and Gazprom (both of which have been previously sanctioned by the U.S.). Soon after, Belarus’ central bank instituted interim management and charged Belgazprombank’s executives, including former CEO Viktor Babariko, with money laundering. Babariko, who resigned in May to launch a presidential bid for November’s election, was seen as the main rival to President Lukashenko and surprised many by polling 10 points ahead.

Babariko’s presidential bid came amid the backdrop of an escalating oil dispute between Belarus and Russia that threatened supplies to Europe, and in which Gazprom played a prominent role. According to Reuters, the Belarus prosecutor general’s office issued a statement that the criminal case had “created a threat to national security.”

The increasingly sensitive and consequential nature of geopolitical struggles highlights the imperativeness of a more holistic view of non-financial risk, and one that not only considers the entity itself, but also its associations and jurisdictional risk. As the last several months have demonstrated, external factors, with its ability to escalate rapidly and often outside of an entity’s control, can significantly affect its risk profile. With a “500% increase in regulatory changes in developed markets” between 2008 and 2016, and projections of 300+ million pages of published regulatory documents by the end of this year, the operating environment will undoubtedly become more challenging.

Last week, FinCEN, the U.S. Treasury’s anti-money-laundering (AML) unit, “warned financial institutions against efforts by kleptocratic regimes and...

This week, the FT, citing a senior government official, reported that the UAE has significantly increased its ability to combat the flow of illicit...

Last week, the U.S. Treasury released a highly anticipated report on money laundering and terror financing in the art market, a mandate by the United...