Last week, Reuters reported that investor groups have asked for more ESG disclosures from the US Securities and Exchange Commission, which had just appointed a renowned critic of weak corporate governance as the agency’s top corporate regulator. From Silicon Valley to Tokyo, some of the world’s largest investors have become increasingly vocal about ESG-related issues. And in a new era of shareholder activism, the calls for more transparency are being heard. For instance, in the case of Toshiba, the head of the parent of the Tokyo bourse operator has urged Toshiba “to swiftly disclose the outcome of its investigation into governance issues.” In fact, according to Bloomberg, so far this year, there have been 169 ESG-related shareholder proposals, with average support of almost 34% of shares. Compared with 173 resolutions filed last year that averaged less than 29% support, the figures are trending towards the most significant year for environmental, social, and governance disclosures.

Yet, for all the benefits associated with ESG-related corporate behavior, the costs associated with not embracing good governance will likely push ESG to the top of shareholder concerns.

According to Fitch Ratings, it is “likely that investors’ growing focus on ESG topics and better ESG-related disclosure will mean that governance failures will have a more rapid impact on credit profiles, notably because of investors shying away from entities with perceived governance weaknesses.” In a special report released last month, Fitch Ratings expects “idiosyncratic governance weaknesses to weigh on ratings more often than previously as the tolerance of governance failures from a wide range of stakeholders (e.g. authorities, investors, creditors, customers and employees) declines.”

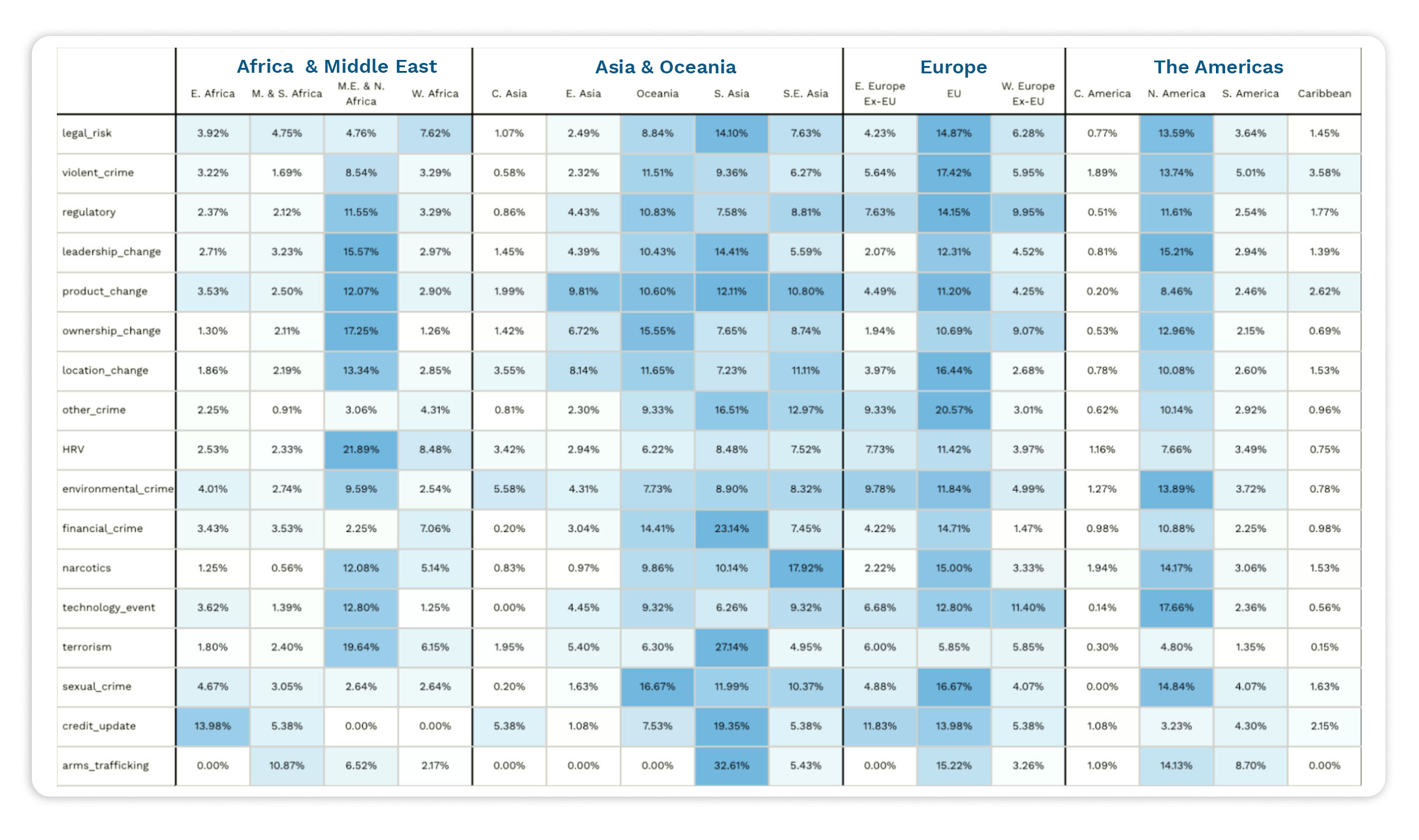

According to a Forbes analysis of the special report, Fitch’s ESG Relevance Scores “demonstrate that governance factors remained the most relevant of all of the ESG factors for credit ratings ‘across all analytical groups, with factors tied to the issuer and broader group structure most prominent for the corporates and financial institutions sectors.’” With Financial Crime Compliance (FCC) costs expected to increase, and as regulators continue to issue record fines, the often largely ignored cost of non-compliance – credit – will likely prove harder to ignore in this new era of shareholder activism that continues to pick up steam.

Last week, the Financial Action Task Force (FATF) released its Report on the State of Effectiveness and Compliance with the FATF Standards, the first...

Every day, millions of articles are published to the Internet across multiple platforms, languages and focal areas. For a risk and compliance...

This month, a new study from the Yale School of Management, which has been monitoring approximately 1,300 companies that do business in Russia, found...